In an era witnessing the rapid devaluation of fiat currencies, the growth of Orwellian autocracy, geopolitical tension, censorship, and general societal confusion over fact versus fiction, Bitcoin is being adopted as the dominant non-state backed monetary system. Simply put, Bitcoin is unseizable wealth riding on a system run by math NOT quasi governmental organizations run by fallible or corruptible officials.

Pictured below is a logarithmic chart showing steady adoption over the course of Bitcoin’s existence.

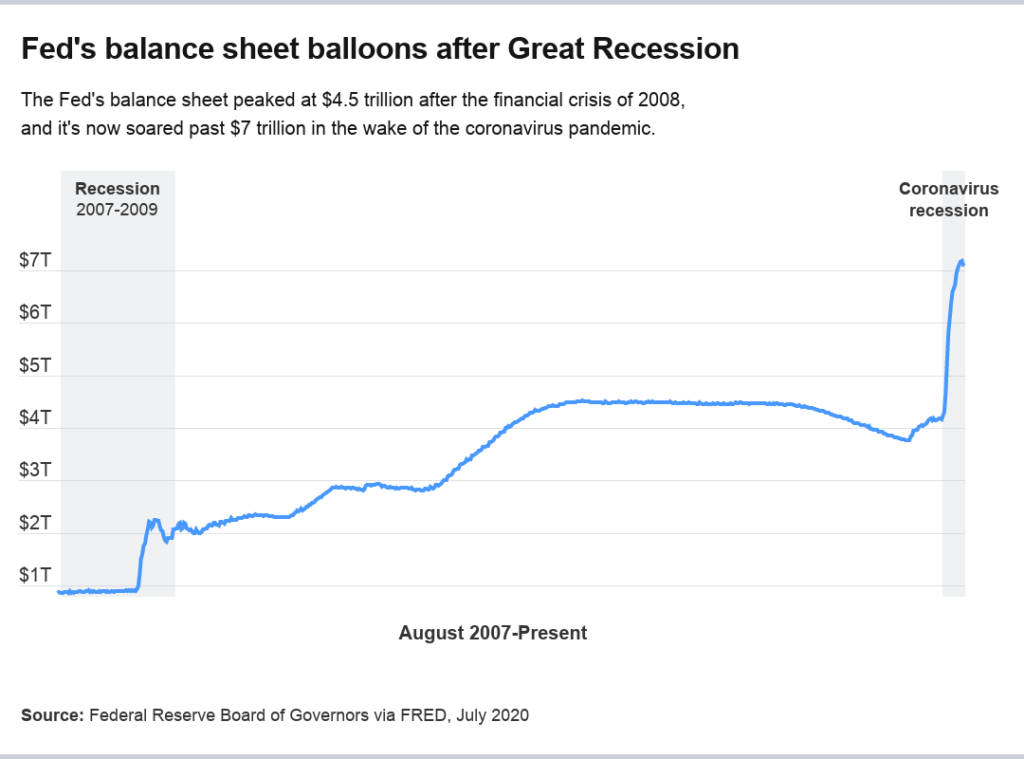

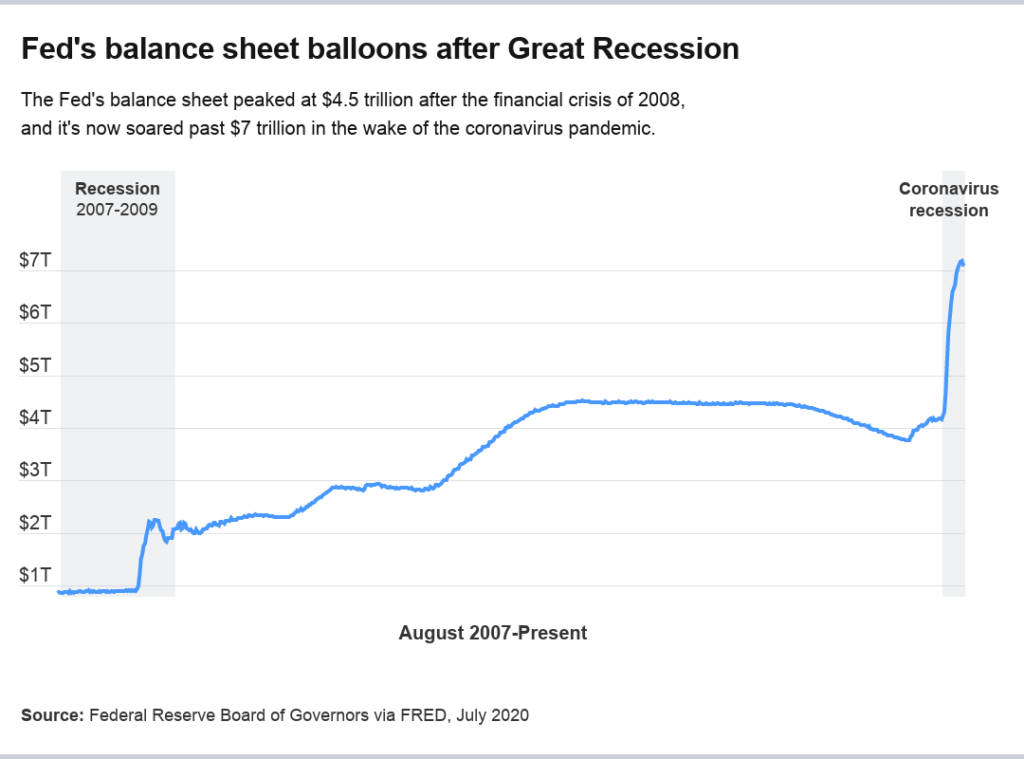

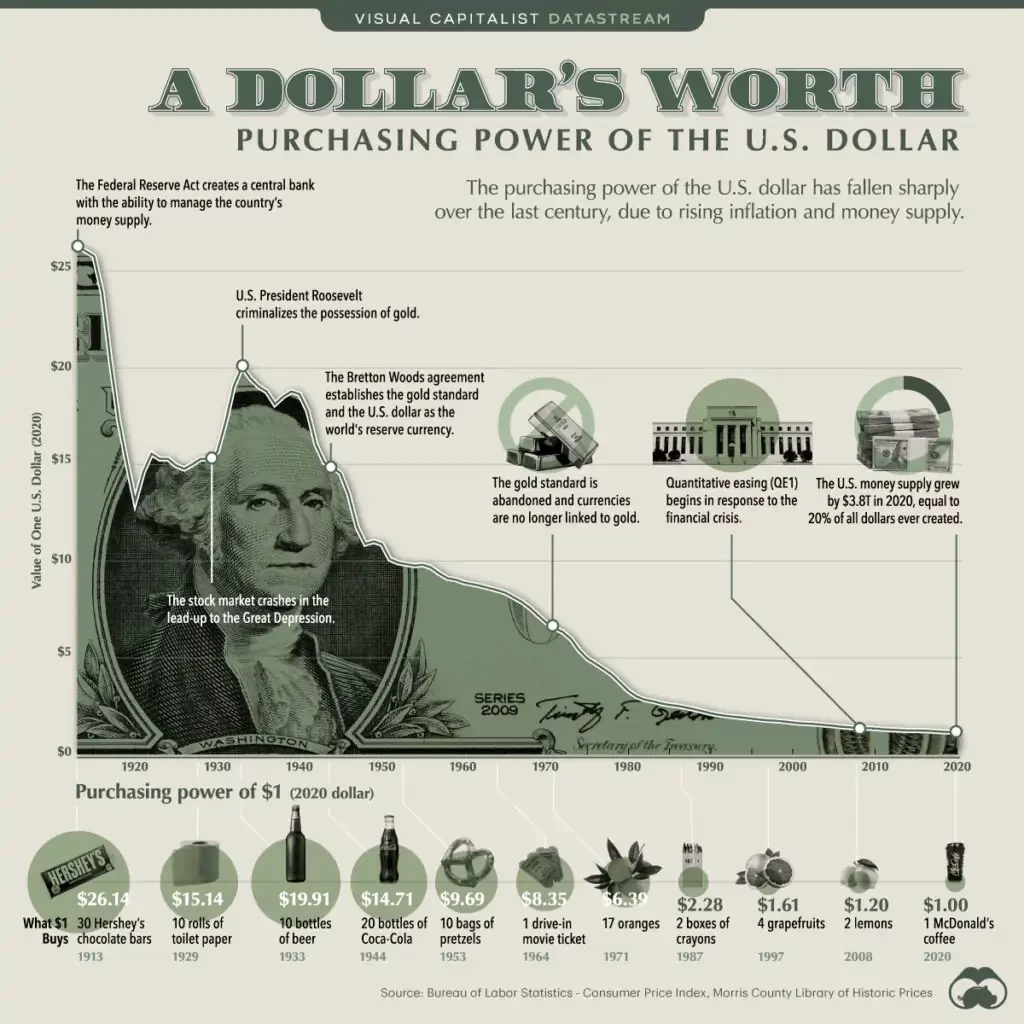

If printing fiat currency is always the answer to financial crisis then how sustainable is the current global financial system? Are your savings (in dollars) at risk?

Between 2007 and 2021, the Fed’s balance sheet has ballooned as it has printed more and more dollars. The European Central Bank and other global central banks have followed the US Federal Reserve’s lead. The global fiat system is in a race to the bottom and due to Bitcoin being uniquely digital (when compared to other alternative assets like gold) it may be the only feasible way to “opt out” of this deteriorating central bank system.

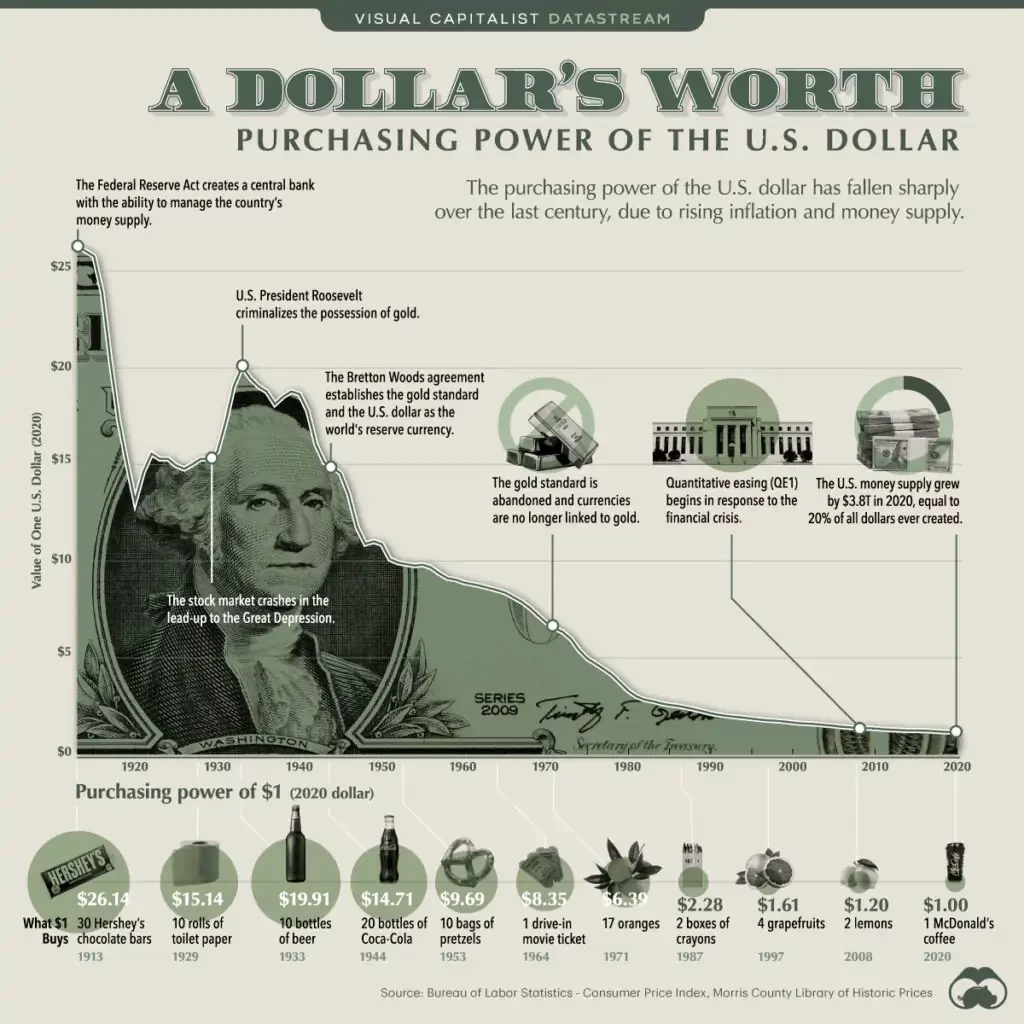

The purchasing power of the dollar has been dropping for over a century.

How to Protect Yourself

Put your Bitcoin purchases on auto pilot with RoundlyX. In order to avoid buying at the “top” or panic selling Bitcoin at the “bottom”, roundup purchasing smooths out buying Bitcoin so investors can avoid the emotions associated with the volatility.

Rounding up the spare change amount on everyday purchases and saving that spare change in Bitcoin allows people to “opt out” of the deteriorating fiat system little by little with every transaction and grow their wealth in an unseizable asset.

RoundlyX will never ask for any account credentials via support, email, or social media.

RoundlyX Inc. does not provide investment advice. All investment strategies and investments involve risk of loss. Nothing contained in this website should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.